UNDERSTANDING YOUR RISK PROFILE

What are your feelings around risk and uncertainty?

Our aim is to present you with the right investments to get the results you need to achieve your goals, and your attitude to risk is a crucial factor when we consider your portfolio. You should have complete peace of mind regarding your financial affairs.

We will never choose high-risk investments for someone with a low tolerance for risk, or vice versa. What’s most important, wherever you are positioned on the risk scale, is for our focus to always be on achieving your lifetime goal.

LEADING ANALYSIS TOOLS

Using your risk profile to tailor your investment strategy

Going the extra mile to fully understand our clients marks us out in our industry. We want to analyse your goals, personal circumstances and outlook, in order to create exactly the right financial strategy for you.

Risk tolerance is a personal trait determined by genetics and life experiences. It isn’t something people can easily describe as it is very rarely thought about. We use the FinaMetrica system, a psychometric approach to discovering your risk tolerance profile and to understand how we need to work with you when selecting investments to meet your goals.

You will need to answer 25 simple multi-choice questions around risks, security and finances, and a complete report will be ready for us to discuss within hours.

- Clarity for couples Those in a couple should each take the questionnaire. Partners rarely have the same tolerance, and addressing differences will promote constructive financial decisions.

- Understanding your own mind Studies have shown people generally do not accurately estimate their own risk tolerance. By taking this questionnaire, we can see for sure which investments will suit you best.

KNOWLEDGE IS POWER

Using your risk profile to tailor your investment strategy

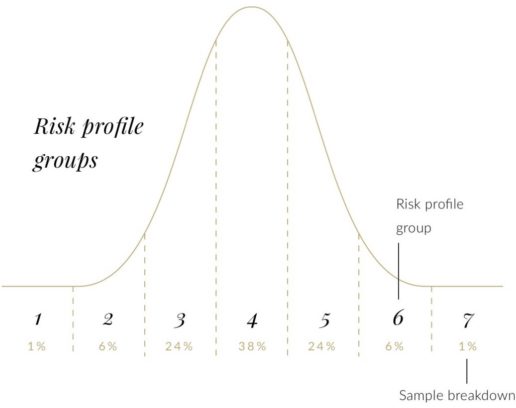

Each of the risk groups above represents a section of the adult population, divided according to their attitude to risk. As you will see, most people fall into groups 3-5, with a very small amount at either extreme of the spectrum. Almost everyone underestimates their tolerance score. Your answers to particular questions will also allow us to understand your risk tolerance in greater detail – for example, you may have higher expectations of returns but see risk as an uncertainty rather than opportunity.

Coupled with Prestwood Professional, our software for financial cash-flow forecasting, our systems represent powerful tools to determine the perfect strategy to secure your financial future.

YOUR OPTIONS

Solutions to suit your lifestyle

Years of helping people use their money efficiently to create a comfortable future has shown us that you all have your own outlook, priorities and ambitions. What’s your vision? We will help you get there.

Your OptionsWORKING WITH YOU

Start planning the rest of your life today

Excited by the thought of your money working harder for you, and creating a secure future for you and your family? Call us today on 01449 615714, or click the button below to drop us a line.

Book a call