Market Commentary – September 2013

Global Roundup

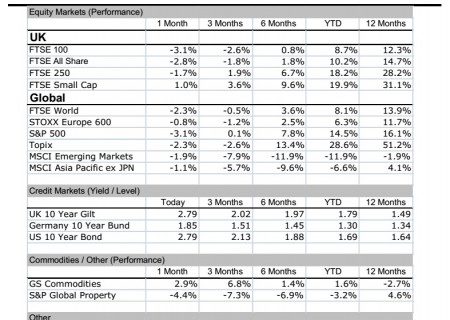

In August both bond and equity markets recorded losses amid increased speculation of when and how much the FED will begin to taper off quantitative easing. The Bloomberg consensus run at the beginning of August indicated that 65% of the economists surveyed expect a $10 billion reduction of the monthly FED purchase to $75 billion – ie. still an expansionary monetary policy. In this climate driven by expectation and uncertainty, is not a surprise that the improving US macroeconomic data has fuelled negative equity performance. Sentiment deterioration was also driven by the intensification of the Syrian civil war which contributed to the FTSE World -2.3% downward movement in August. Commodities were the only asset class that returned positive during August, with Gold and Silver being the top performers. September is going to be a very eventful month with the FOMC meeting on the 17th-18th, the anticipated German federal election on 22nd,another round of discussions on the US Debt Ceiling which will apparently be reached once again by mid-October, Greece’s intention to renegotiate the bailout terms, as 10 billion Euro hole in its finances may appear and finally the US Congress vote on US armed intervention in Syria.

UK Summary

The UK macroeconomic readings pictured an improving economy that was also captured by the market indices. The FTSE Small Cap index, that gives exposure to the UK economy retuned 1% positive in August while the FTSE 100 with its mega cap, global companies returned a negative -3.1%.

European Summary

European equity markets followed the global trend down but with a lower propensity on the downside due to better than expected macroeconomic readings. The Euro zone Manufacturing PMI in August had a 51.3 reading, the highest reading over the last two years and the second month with a value above 50 that indicates expansion. We have to mention the encouraging German reading that indicates the German economy being once again the driver of the European recovery. We should not be deceived by the seemingly calm situation that has characterised peripheral Europe in the past 7months, with significant deficits still looming this could impact future performance.

US Summary

Positive macroeconomic data characterised the US economy in August with unemployment at 7.4%, the lowest since February 2009 and the second quarter GDP expanding at a 2.5% annualised rate. In normal circumstances the equity markets would cheer these macroeconomic readings, but because of the uncertainty regarding the FED QE tapering market indices had a downward trajectory with S&P 500 falling -3.1%.

Japan Summary

In Japan, the TOPIX lost -2.3% during August as the local participants are still waiting for proof that the new economic and monetary policies are working. Inflation is far below the 2% target which might force the BOJ to take further expansionary actions. On the other hand, the Q2 GDP increased to 3.5% annualised.

Emerging Markets Summary

Unlike the past couple of months the situation in emerging markets has been rather calm. The beginning of the month was marked by conflicting data regarding the Chinese manufacturing activity with government data showing expansion with a reading of 50.3 while the HSBC index showed another month of contraction with a reading of 47.7. We have to mention that this reading was the lowest of the past eleven months. In the end the Chinese market closed the month with a 6% increase. Brazil revealed a program to support its currency after Brazilian Real had lost heavily against the US dollar due to capital outflows. The Indian market underperformed on the downside with both currency and equity markets moving south.